Roth Ira Contribution Limits 2025 Catch Up Contribution. Individuals aged 50 and older can contribute an. It’ll be $11,250 in 2025.

The roth ira contribution limit. For 2025, the roth ira contribution limit holds steady at the same level as 2025.

401k Limits 2025 Over 50 Catch Up Phil Hamilton, Individuals aged 50 and older can contribute an.

Ira Contribution Limits 2025 Catch Up Limits Heda Pearle, That means you can contribute $7,000.

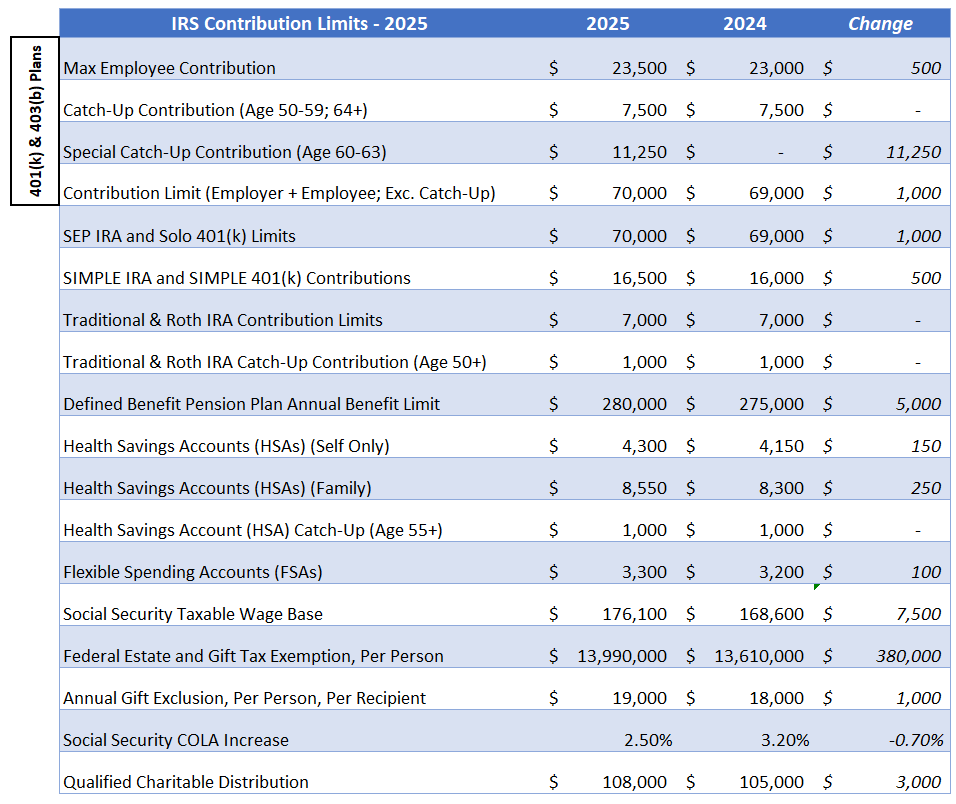

2025 Roth Ira Contribution Limits Catch Up Ali Bellanca, Here’s a breakdown of the estimated ira contribution limits for 2025, along with some other key retirement accounts:

2025 Roth Ira Contribution Limits Catch Up Ali Bellanca, The maximum roth ira contribution limit for 2025 is the same as for 2025, which is $7,000 for those under 50, and an additional $1,000 in catch up contribution for those 50 and older.

Roth IRA Limits And Maximum Contribution For 2025 2025, The maximum roth ira contribution limit for 2025 is the same as for 2025, which is $7,000 for those under 50, and an additional $1,000 in catch up contribution for those 50 and older.

2025 IRS Contribution Limits For IRAs, 401(k)s & Tax Brackets, The irs has also adjusted the income limits for roth ira eligibility, allowing more people to qualify for roth contributions.

401k 2025 Contribution Limit Ciel Melina, The irs has also adjusted the income limits for roth ira eligibility, allowing more people to qualify for roth contributions.

2025 401k Catch Up Contribution Limits 2025 Pdf Download Sam Churchill, It’ll be $11,250 in 2025.