After Tax 401k Contribution Limit 2025. — increased maximum contribution limit: The total employee contribution limit to all 401(k) and 403(b) plans for those under 50 will be going up from.

— for 2025, the 401 (k) contribution limit for employees is $23,000, or $30,500 if you are age 50 or older. For 2025, the 401 (k) limit for employee salary deferrals is $23,000, which is above the 2025 401 (k) limit of $22,500.

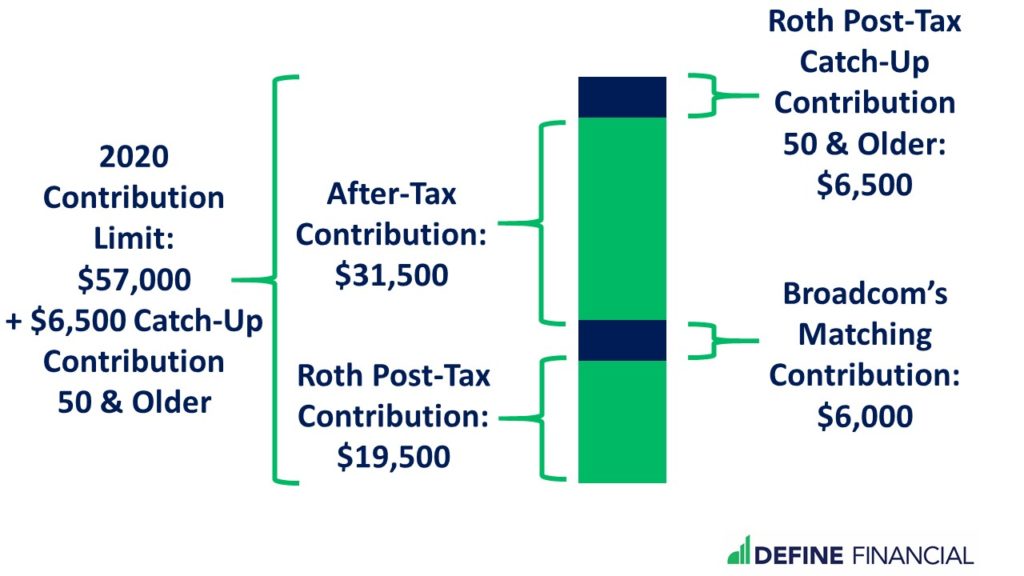

Total 401k Contribution Limit 2025 After Tax Gisele Pearline, — the total maximum that can be tucked away in your 401 (k) plan, including employer contributions and allocations of forfeiture, is $76,500 in 2025.

Contribution Limits 401k 2025 After Tax Robin Leonie, — the 401 (k) contribution limits for 2025 are $23,000 for individuals under 50, and $30,500 for those 50 and older.

Contribution Limits 401k 2025 After Tax Franny Nikaniki, This amount is up modestly from 2025, when the individual.

Total 401k Contribution Limit 2025 After Tax Gisele Pearline, — the 401 (k) contribution limits for 2025 are $23,000 for individuals under 50, and $30,500 for those 50 and older.

Irs Solo 401k Contribution Limits 2025 Eleen Bertina, — 401 (k) contribution limits in 2025 and 2025.

After Tax 401k Contribution Limit 2025 Fran Cariotta, This amount is up modestly from 2025, when the individual.

2025 Irs 401k Limit After Tax Daisi Edeline, — your annual contribution is capped at $23,000 in 2025.

401k Limits 2025 After Tax Kaia Sisile, — there is no specific minimum income requirement for contributing to a roth ira, but you must have earned income to make contributions.