2025 Medicare Income Limits Chart For Part. In 2025, the premium is either $278 or $505 each month, depending on how long you or your spouse worked and paid medicare taxes. Medicare recipients with 2025 incomes exceeding $103,000 (single filers) or $206,000 (married filing jointly) will pay a premium between $244.60 and $594.00.

The 2025 part b deductible is $240 per year. Each year, the united states social security administration establishes irmaa income brackets that determine whether you need to pay fees on top of your medicare part b.

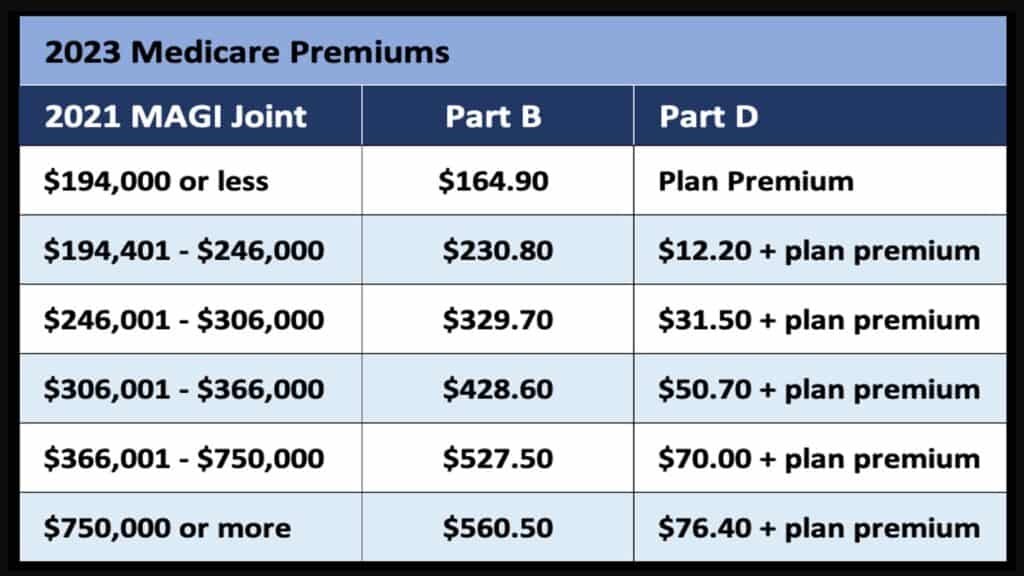

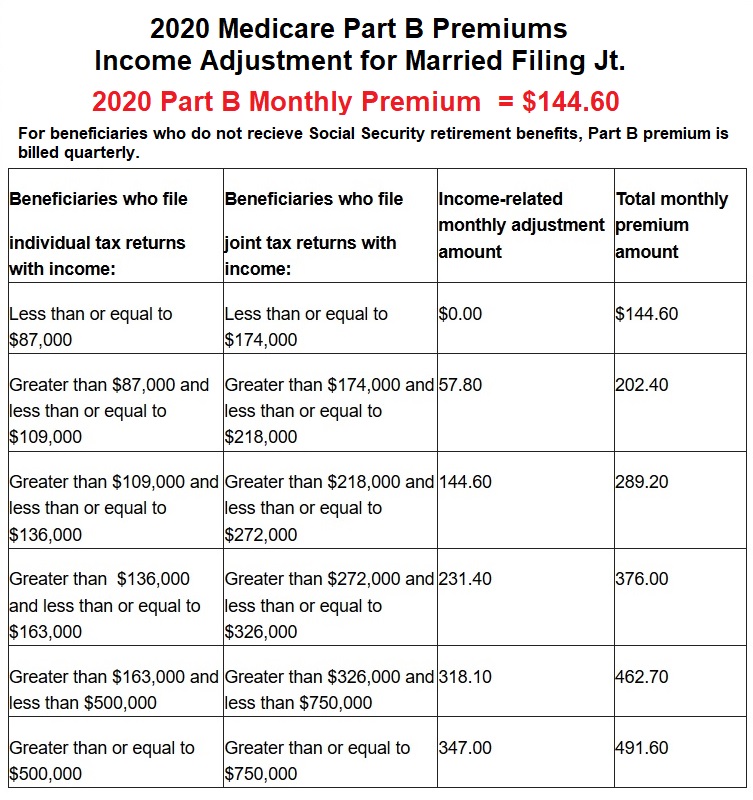

Limits For Medicare Premiums 2025 Winna Cissiee, The following table shows the income brackets and irmaa amount you’ll pay for part b and part d in 2025 (based on your 2025 tax return):

2025 Medicare Part B Limits Lulu Sisely, Each year, the united states social security administration establishes irmaa income brackets that determine whether you need to pay fees on top of your medicare part b.

Limits For Medicare 2025 Heidie Regine, Knowing the 2025 coinsurance rates and how irmaa affects medicare part b and d due to income can save you money.

2025 Medicare Premiums Limits Chart Wilma Juliette, Understanding your agi’s role in this process is key for.

2025 Medicare Limits Chart Kyle Klarrisa, Knowing the 2025 coinsurance rates and how irmaa affects medicare part b and d due to income can save you money.

Medicare Premiums 2025 Brackets Chart Eula Tammie, The following table shows the income brackets and irmaa amount you’ll pay for part b and part d in 2025 (based on your 2025 tax return):